Must Listen! Rush Explains Who Pays Taxes

BRETT: So just a few weeks ago I was here behind the Golden EIB Microphone, and a caller named Monte from North Carolina called in to the program and said he wanted to teach a course at his alma mater on Rush. It was a great idea because there’s so much you can learn from listening to this program every day.

Rush covered numerous subjects and was the best teacher we ever had, which is why we’re continuing to share his words and wisdom every single day. Speaking of which, we have a monologue of Rush explaining who pays taxes. It’s a must listen. We’re gonna play it now.

RUSH: Mick Mulvaney, who is a Rush Baby. We’ve interviewed him for The Limbaugh Letter, and he is the director of Office of Management and Budget. You know, it turns out yesterday I was wrong about something, and it’s rare when I’m wrong. It’s so rare, people love pointing it out.

By the way, Dawn, were you up today at 3 o’clock to order the new iPhone X? (laughing) No, I don’t get up at 3 o’clock to order phones. Even if I was up at 3 o’clock, I wouldn’t have ordered that. No, no, no, no, no, no, no. I was just teasing. I knew you weren’t up. It’s not on your list of prioritized interests. That’s why I asked you. I was just being facetious.Anyway, I thought yesterday that the top 1% are paying 40% and the top 10% were paying 60% of total tax revenue. There was a poll, it’s a Fox News poll, and it’s got some of the screwiest results in it. Something like 80% of the American people don’t think the rich are paying enough, unusually high numbers of people who think the middle class are paying too much. And none of that is accurate, but it’s what people think. And so that’s why there’s not gonna be a tax rate cut for the top 1%, or maybe even top 5%’s ’cause of that polling data. There’s not a politician in the world that wants to be seen giving the rich a tax cut when 80% of the people or 78% think the rich aren’t paying enough already.

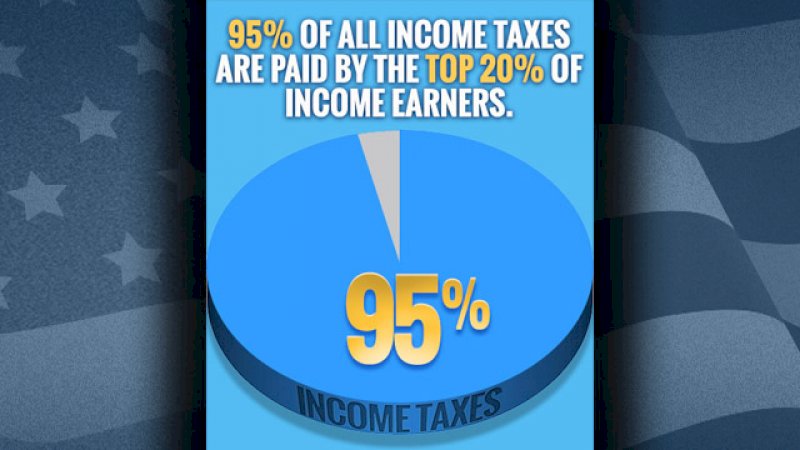

But the real numbers are even more shocking. Try this, folks. Ninety-five percent of all taxes are paid by the top 20%. That is an all-time high. It has never been there. Last night, Georgetown University, Mick Mulvaney, who is the director of the Office of Management and Budget, spoke about Trump’s tax reform plan. And the moderator was somebody named Cathy Koch, and she said, “The way the benefits of this tax cut falls across different income taxes is going to be a real arithmetic trick.”

Does anybody know what that question means? This is a moderator of the event. Let me read the question. “The way the benefits of this tax cut falls” — it should be “the way the benefits of tax cut fall.” But “the way the benefits of this tax cut falls across different income taxes is going to be a real arithmetic trick.” What is the different income taxes? Now, I, your host, know what she meant. The way the benefits of this tax cut fall across the different rates, the different brackets, is gonna be a real arithmetic trick. No, it isn’t. There’s no trick here. There aren’t any arithmetic tricks. Arithmetic, math, is just pure logic. Anyway, here’s Mulvaney’s answer to whatever that question was.

MULVANEY: Top 20% pay 95% of the taxes. If you break the income tax universe into what we call quintiles, so equal sized 20% columns, the first two columns, the first quintile and the lower quintile, don’t pay any taxes at all. In fact, they net positive. We pay them when they file a tax return. That middle quintile, which you might describe, some people do, as middle class, pays an effective rate in the low single digits. And all of the taxes are paid by folks in the top two quintiles, and that last quintile pays almost fully, 95% I think, of the taxes.

RUSH: This is just unreal. Now, if you’re still confused about a quintile, it’s just dividing by five instead of by quarters. So they’re dividing the taxpayers into five different groups here, and each one of them equals 20%, obviously. So the top 20%, that top quintile, pays 95% of all income taxes. The top 20%! Now, let me give you another startling statistic. Now, this is not gonna be exact because I haven’t seen the recent revision of this.

But five years ago, this was true. If you earned $55,000 a year, you were in the top 10% of income earners in America. Is that not shocking as well? Now, we think of the top 20% as the gazillionaires, the billionaires, the millionaires — and they’re in there, but you really need to go to the top 1% to get the gazillionaires and the billionaires, and the top 5% to pick up everybody that are millionaires — and maybe that wouldn’t even do it. Maybe the top 2%, 3% at most, is what you would do if you want to include millionaires in this.

So the top 20%, that’s a pretty broad income spectrum there. It still is just unreal that the top 20% are paying 95% of all tax revenue. You balance that against what the Fox News poll yesterday found. Nobody is aware of this. Well, not nobody. You are, because we’ve made this a seminal point of this program for all of the years that we’ve been here, because it matters. But a full 80% of taxpayers are paying 5% — and, as Mulvaney said, the bottom 40% are paying nothing and in effect are being given a refund every year via the earned-income tax credit.

There simply isn’t any truth to the notion that the rich are not paying their fair share, and there isn’t any truth to the notion that the middle class are paying most of the burden, and then Mulvaney… Now, this gets tough to listen to, because it’s numbers, but he tries to explain the math behind the so-called tax cut for the rich.

MULVANEY: People always ask all the time: “Why do you want to give a tax cut to the rich?” Here’s the math. We have a progressive tax system, which means that if you make a million dollars and a make $50,000, we both pay the exact same rate on the first, let’s say, $20,000. And then from the next 20 up to my 50 — and her next 20 to her next 50 — we pay the same. I think it’s now… I know it’s 12% or 15%.

I can’t remember what the brackets are, and then she goes on to make her higher rates and I stop, right? Well, if you want to give me in the middle class a cut you take my 15% rate say down to 10%, right? That gives a middle class a cut. Guess who else benefits from that? She does, because she pays the same rate on the way up the brackets. You can sit there and do nothing and lower the rates on the middle class and all other things being equal you’re gonna give the rich a tax cut.BRETT: That’s Rush breaking down the tax rates, and that is the first part. The second part, you’re gonna hear in this next hour. You are going to hear a discussion of what those numbers mean. But it’s astounding to think about all the taxes that this new proposal is gonna come out with tonight from President Biden, and he’s gonna have everybody doing great except for the, quote, “rich.”

Well, many wealthy people don’t make million-dollar salaries, right? They’re remunerated in a number of ways. They’re paid in a number of ways. They get some salary, they get stock options, they get ownership, they get equity (which means something totally different in the world of business than what it does in the classroom at a community college someplace).

So all these things are in play. It’s a dynamic environment out there. It’s not some rich billionaire getting a billion dollars a month paid to him by some company and he’s got a closet filled with cash that he can just light his cigars with. And unfortunately, so many people in government, they trade on that idea that you’re not gonna really understand the facts.

BREAK TRANSCRIPT

BRETT: Shepherd is in Ocala, Florida. Shepherd, welcome to the program.

CALLER: Hi, Brett. I called a few days ago, but unfortunately to bow to my business and pick up somebody at the airport. What I wanted to talk about was class envy. Now, I grew up a welfare kid in the Bronx. I’m 60 years old.

BRETT: Gotcha.

CALLER: And with my family — by the way, my father sounded exactly like Bernie Sanders. So with my family, it was all… Believe me, he sounded exactly like Bernie Sanders. He didn’t talk, sounded just like him, exactly like — and “the rich get richer and the poor get poorer.” Anyway, with him it was always, “Tax the rich! Screw the rich! Take it from the rich.”

BRETT: Right.

CALLER: “They got their money by lying, cheating, steeling stealing and standing on the backs of the poor,” and if they didn’t they were just plain lucky and they inherited it. My family not only hated wealthy people, they hated anyone who had even a little bit more than they had. If my father owned a Ford and our neighbor down the street owned a Buick, dad was not happy.

Okay. Fast-forward to 2012. My dear aunt passed away in New Jersey. Very high-tax state. My brother and I were to receive an inheritance. While we were meeting with the executor of her will… Not enough to make us wealthy, mind you, but enough to make life easier. So we’re meeting with the executor of her will, and he’s going over the probate process and approximately what we would receive after taxes. And my brother, a typical New Yorker, said, “Wait a minute. Wait a minute. What taxes?” and he was explaining all the taxes, and my brother hit the ceiling. He says, “Wait a minute here!” I’m cleaning up what he said.

BRETT: Sure.

CALLER: He said, “Our aunt and uncle already paid taxes on this money. Why is it being taxed again?” The irony was so delicious, I couldn’t resist taking the other side. I said, “Wait a minute, now, Mr. Tax-the-Rich. We’re going to have paid-off homes, paid-off cars, nice little something in the bank, nice little something in retirement. Don’t you think we should pay our fair share? Hmm?”

And he says, “But we’re not rich.” I said, “To some people, we are. Now the shoe is on the other foot. How does it feel?” Well, he started using some choice language and the executor stepped in and said, “Excuse me, gentlemen. This is a legal proceeding. Would you mind keeping your bickering at home?” One more thing here. I have written a book series on this class envy garbage. I have experienced class envy within my own class.

BRETT: Thank you. I appreciate you being out there, Shepherd.

BREAK TRANSCRIPT

BRETT: I want you to hear Part 2 of Rush’s breakdown of who it is that pays taxes.

RUSH: There simply isn’t any truth to the notion that the rich are not paying their fair share, and there isn’t any truth to the notion that the middle class are paying most of the burden, and then Mulvaney… Now, this gets tough to listen to, because it’s numbers, but he tries to explain the math behind the so-called tax cut for the rich.

MULVANEY: People always ask all the time: Why do you want to give a tax cut to the rich? Here’s the math. We have a progressive tax system, which means that if you make a million dollars and a make $50,000, we both pay the exact same rate on the first, let’s say, $20,000. And then from the next 20 up to my 50 — and her next 20 to her next 50 — we pay the same. I think it’s now… I know it’s 12% or 15%. I can’t remember what the brackets are, and then she goes on to make her higher rates and I stop, right?Well, if you want to give me in the middle class a cut you take my 15% rate say down to 10%, right? That gives a middle class a cut. Guess who else benefits from that? She does, because she pays the same rate on the way up the brackets. You can sit there and do nothing and lower the rates on the middle class and all other things being equal you’re gonna give the rich a tax cut.

RUSH: Now, let me walk you through this. Did you…? Snerdley, did you understand that? (interruption) Yeah, it’s tough when you’re using numbers. It’s really tough when you’re using numbers. I’m gonna use different examples than the Office of Management and Budget director. I’m gonna use $100,000 ’cause it gives us more room to play here. We’ve got the brackets, and we’ll use the brackets of 39%, 35%, 28%, and 15%, and we’re talking about income of $100,000. If you make a $1 million, you still make $100,000 and to start with.

Not all of your $1 million is taxed at the… Well, no. In the case of millionaires, it is. In the case of millionaires, they don’t step through this. They charge you 39% on pretty much everything. So let’s say it’s income of $500,000. The person that makes $100,000 will pay on the first $10,000 or $20,000 and he earns the 12% or 15% rate, and then the next bracket of that $100,000 a year until pay at 28%. And then the last percentage of that $100,000 he earns he will pay the top rate of 35%. That’s the marginal rate.

The marginal rate is the last rate you pay on the income you earn. So if you earn $100,000 and somebody earns $50,000, you pay the same percentage on the income that’s equal: $50,000. The person making $100,000 earns $50,000 first, and the person earning $50,000, they pay the same rates on that they pay the same rates on that $50,000. Then the guy that’s earning a hundred has two more rates to pay on his way. He’ll have 28% and 35%, and I don’t know where the 35% kicks in.

But the point is the guy earning $100,000 is paying the same percentages on half of his income as the person making the person making $50,000. Mulvaney’s point is if you cut the 12% rate and the 15% rate, you’re also gonna be cutting that rate for the guy making $100,000 because the first $50,000 he makes will also be subject to the new lower rates. So his point is, when you lower rates for the middle class, you cannot help but lower rates for everybody, because everybody is gonna be subject to all of those brackets up to the total taxable income they report.

We’re talking taxable income here: $100,000 versus $50,000. So the person earning $50,000 will pay taxes… Well, actually, this person doesn’t pay much at all, but in the math example we’re using, that person would pay a percentage at 12% and a percentage at 15% and be done. The person making $100,000 would pay the same 12% and the same 15% up to his first $50,000, but then two more rates kick in for him: 28% and 35% on his way to a hundred grand.

But those first two rates — the 12% and the 15% — if they’re cut to 10% and 12%, they’re gonna be cut to 10% and 12% for everybody. So Mulvaney’s point is, you cut the middle class tax rates, it is axiomatic, it’s automatic, and it is unavoidable that the rich are gonna get the same tax cuts on the first $50,000 they earn. Not everything, just the first $50,000. So that’s what he was trying to explain here.

Let me give you one more stat here, folks, to illustrate who really pays taxes. What’s the population of New York City? Give me the number. What…? (interruption) Just the city. I’m not talking about the Tri-State area. Eight million people. Well, it’s probably 7.5 million because half a million have probably have left since the last time, but we’ll figure eight million, okay? Would you believe that one half of New York City’s tax revenue…?There are eight million people, and one half of the city’s income is paid by 34,500 people? They are the rich. They are the people not paying their fair share: 34,500 people out of eight million are paying nearly half (or as Clinton would say, “contributing”) nearly half of the city’s taxes. You remember Clinton when he was raising everybody’s taxes referred to them as “contributions.” We needed more “contributions” from people.

But, see, even these facts are not gonna sway anybody. It’s just etched in stone that the rich don’t pay their fair share, that the rich get all these tax breaks, that the rich aren’t paying anything, and that the middle class is bearing the full burden, and people believe it because the Democrats and… Hell, it’s not just Democrats. The media, everybody’s been spreading that BS for decades. And it’s become part of the traditional class envy.

BRETT: So, again, people will think that, “Oh, it’s just a rich guy getting stuck with that,” but if the rich guy owns a business that’s employing people in the Borough of Manhattan in the City of New York or in any of these places that are high taxed and they decide, “Well, I’m getting hit twice, because I’m getting hit now at the local; I’m getting hit at the federal.

“Oh, and I’m getting hit on my capital gains for any investments I made. Oh, and I’m paying that other side of Obamacare — and, oh, if I go to 50 employees, now I’m gonna get hit on Obamacare.” You think about how all this stuff adds up (and you’ve got property taxes). People start to say, “You know what? I’m going to leave. I’m just going to leave.”

Why did all those corporations leave the United States to go overseas when you had President Trump then pass that corporate tax cut to move back to the United States to repatriate trillions of dollars? Why was that? Why did they flee the United States? Because the tax rate was too high. Individuals who owned businesses, individuals who owned franchises, individuals who are investors.

Money is mobile! You can take your money anywhere. You can fold up a corporation here and put it someplace else around the world and open it there and pay a lower rate. But see, that’s the scary part of what Janet Yellen, the secretary of the Treasury is talking about, because going around to all these other countries, 25, 30 countries.She’s saying, “We need a global minimum tax rate, meaning an agreement that we all come to that says, ‘Nobody goes below 25% on the corporate rate or nobody goes below 28% on the corporate tax rate,’ because we need to not only pick the pockets of the wealthy and the strivers — those people attempting to become wealthy, those people creating wealth.

“But we need a way to put them up against the wall and take the wallet out of their pocket so that they can’t escape from us and go hide out in Ireland or Gibraltar or Singapore or what have you.” You want to talk about collusion? Collusion to keep your dollars out of your account is what they’ve got cooked up. They’ll never talk about it that way, though. They’re talking about “tax fairness.” End of Transcript,

Comments are Closed